Commercial properties can be a

good investment opportunity. For your money, commercial properties typically

offer more financial reward than residential properties, such as rental

apartments or single-family homes.

Although residential and

commercial properties both have proven to be excellent and profitable

investments, commercial real estate

investing might be a better option for property investors who are

willing to undertake a large venture.

Obtaining a large sum of capital

in commercial real estate investing is much easier as there are many financing

options to choose from. As a commercial real estate investor, not only do you

have the ability to raise capital by using traditional financing options, but

you can also use the help of hedge funds, investment groups, and private equity

firms. Commercial property investors can also pool capital and have access to

more financing to purchase the investment

property.

Other benefits include:

Income potential

Commercial

properties generally have an annual return off the purchase price between 6%

and 12%, depending on the area, which is a much higher range than typically

exists for single family home properties (1% to 4% at best).

Professional relationships

Small business

owners generally take pride in their businesses and want to protect their

livelihood. Owners of commercial properties are usually not individuals, but

LLCs, and operate the property as a business. As such, the landlord and tenant

have more of a business-to-business customer relationship, which helps keep

interactions professional and courteous

More objective price evaluations

It's often easier

to evaluate the property prices of commercial property because you can request

the current owner’s income statement and determine what the price should be

based on that. If the seller is using a knowledgeable broker, the asking price

should be set at a price where an investor can earn the area’s prevailing cap

rate for the commercial property type they are looking at (retail, office,

industrial, etc.). Residential properties are often subject to more emotional

pricing.

Multiply current cash-flow through leverage

When

investors place “positive leverage” on an asset, they effectively multiply their net spendable cash by borrowing money at

a lower cost than their property returns back to them. A quick example: your

friend loans you $10 and asks for $11 back, one dollar interest….you

immediately loan that $10 to someone else and ask for $2 interest…paying back

the $11 owed and making a profit with no additional investment…you just

participated in positive leverage.

Triple net leases

There are

variations to triple net leases, but the general concept is that you as the

property owner do not have to pay any expenses on the property (as would be the

case with residential real estate). The lessee handles all property expenses

directly, including real estate taxes. The only expense you’ll have to pay is

your mortgage. Companies like Walgreens, CVS, and Starbucks typically sign

these types of leases, as they want to maintain a look and feel in keeping with

their brand, so they manage those costs, and you as an investor get to have one

of the lowest maintenance income producers for your money. Strip malls have a

variety of net leases and triple nets are not usually done with smaller

businesses, but these lease types are optimal and you can’t get them with

residential properties.

Less Competition

Investing in commercial properties

(like office buildings and shopping centers) is a huge undertaking. This is why

so many property investors shy away from commercial

real estate investing. In addition, there are a variety of commercial

property types, such as industrial, retail, office, and apartments, and not to

mention that within each property type there are also numerous sub-types to

choose from. For an experienced property investor willing to take a risk,

commercial real estate investing

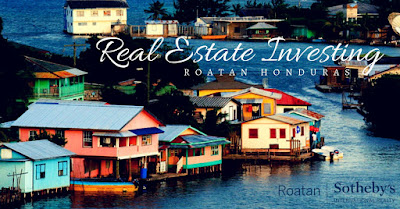

Why choose Roatan?

Roatan and its neighboring Bay Islands are among the most

beautiful destinations in the all the Caribbean. These lush, tropical islands

enjoy extremely comfortable year-round temperatures, averaging 27°C (80°F), and

boast of white-sand beaches, lush landscapes, exceptional water sports, a great

standard of living, and friendly locals.

There is so much that awaits to be discovered in Roatan

so come and let us show you around! The islands remain among the most

affordable Caribbean islands in terms of real estate and quality of

living. We know that after just one visit Roatan and they Bay Islands

will become one of your favorite places in this world too!

Roatan Sotheby’sInternational Realty (SIR) was founded in 2017 to clients a unique level of

service that can’t be found elsewhere on the island. For the first time, our

sellers will be given the opportunity to leverage the global reach of the

Sotheby’s International Realty brand to deliver an unmatched level of results.

Roatan SIR will also offer our buyers unrivaled expertise on the local real

estate market combined with access to the island’s most exclusive listings and

unparalleled customer service. In short, our focus is both local and global,

and it is a proven approach to generate results.

Our company rests on the principles of integrity,

transparency, and a genuine commitment to excellence. We pride ourselves on

delivering exceptional experience through our unparalleled customer service and

local expertise with global reach.